Book a Valuation

Thank you for submitting your request, we will get back to you within 72 hours with a response.

February 9, 2024

Explore the ever-changing landscape of the Isleworth property market, where the dynamics of property sales fluctuate across different price ranges. Are homes in the lower priced market selling faster than those in the upper market in Isleworth, or is it the other way around? Dive into our detailed analysis to uncover the trends shaping Isleworth’s property scene and find out which segment of the market is truly leading the way.

Inflation, interest rates, house prices down, house prices up … the newspapers are full of column inches on Brit’s second favourite topic – the property market (the first being the weather obviously!).

Those of you that read my articles on the Isleworth property market know I like to look further afield to compare the Isleworth market with the regional and national markets. The one thing that is immediately apparent is that the UK does not have one property market.

House prices are up in one region of the UK, yet down in another. It is a hotchpotch patchwork (almost like a fly’s eye) of lots of small property markets all performing in different ways.

… and that made me think …

So, I decided to dive into the dynamics of the Isleworth housing market, to see if it operates as a singular entity or if the diverse price ranges significantly influence a property’s saleability.

This curiosity stems from the observation that properties, much like a spectrum, range from modestly priced to premium priced. Such variations in pricing could potentially carve out distinct segments within the market, each with its own trends and buyer behaviours.

I decided the best way was to split the Isleworth property market into four equal sized distinct price ranges, each representing a unique slice of the market.

The lowest quartile forms the base layer, representing the most affordable 25% of homes – these are typically the most accessible for first-time buyers and buy-to-let landlords. Next up is the lower middle quartile, the second layer, encompassing properties priced between the 25th and 50th percentiles.

These homes offer a step up in features, style or location while remaining within a moderate price range.

Ascending further, the middle upper quartile, the third layer, includes homes priced between the 50th and 75th percentiles, appealing to buyers looking for more amenities or premium locations.

At the top sits the upper quartile, the cream of the crop, representing the most expensive 25% of properties in Isleworth. These homes are often luxurious, boasting high-end features and coveted locations, and are sought after by those who desire the best the market has to offer.

By segmenting properties into these quartiles, we gain insight into their saleability and can tailor strategies to target buyers effectively within each segment.

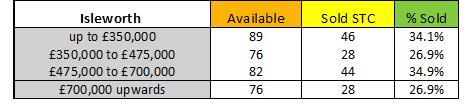

These are the quartile/house price bands for Isleworth:

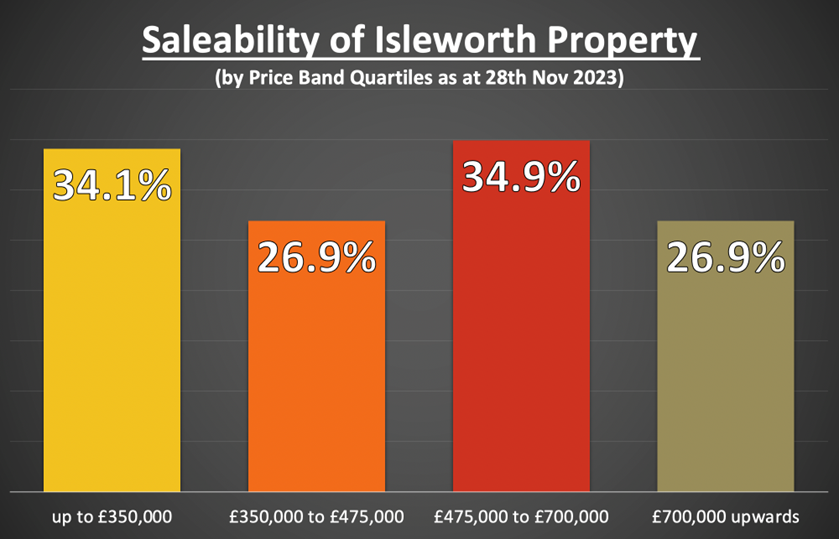

So, having split the Isleworth property market approximately into four equal sizes, the results in terms of what price band has sold (subject to contract or stc) the most is quite enlightening –

The statistics across various price ranges present an interesting pattern. For properties priced up to £350,000, there are 89 available, with 46 already sold subject to contract (STC), representing a 34.1% sale rate.

In the next price band, £350,000 to £475,000, there are 76 properties available, with 28 sold STC, accounting for a 26.9% sale rate.

The £475,000 to £700,000 range shows 82 properties on the market, of which 44 have been sold STC, indicating a 34.9% sale rate.

Lastly, for properties priced at £700,000 and upwards, there are 76 available, with 28 sold STC, resulting in a sale rate of 26.9%.

The best performing price range/quartile in the Isleworth area is the upper middle quartile market, with the middle lower quartile upper quartile ranges finding things tougher.

The market’s behaviour is akin to a kaleidoscope, with each turn revealing a different pattern based on the price segment. This diversity in performance across various price bands/quartiles is indicative of a market that caters to a wide spectrum of buyer preferences and financial capacities.

The most illuminating insight from this investigation is the relative success of different price quartiles.

The upper middle quartile, encompassing homes between £475,000 and £700,000, has shown remarkable resilience, with a high percentage of properties going under contract.

This disparity in market performance underscores the importance of understanding Isleworth’s property landscape through a segmented approach.

By recognising the unique characteristics and demand drivers within each quartile, estate agents, buyers, and sellers can make more informed decisions.

As an Isleworth estate agent, this insight into the local market’s nuances not only enhances our ability to advise clients but also reinforces our commitment to providing tailored solutions that resonate with the diverse needs of the Isleworth community.

By Pavan Chaudhary 28-11-2023